Another new private catastrophe bond transaction, or cat bond lite deal has come to light, with $15 million of privately placed Kettering insurance-linked securities (ILS) notes issued by a Bermuda based Artex Risk Solutions operated transformer entity, Artemis has learned. It’s the fifth private cat bond issuance we’ve seen so far in 2025 from the Artex Axcell Re (Bermuda) Limited transformer and cell facility, which is owned by Artex Risk Solutions.

It’s the fifth private cat bond issuance we’ve seen so far in 2025 from the Artex Axcell Re (Bermuda) Limited transformer and cell facility, which is owned by Artex Risk Solutions.

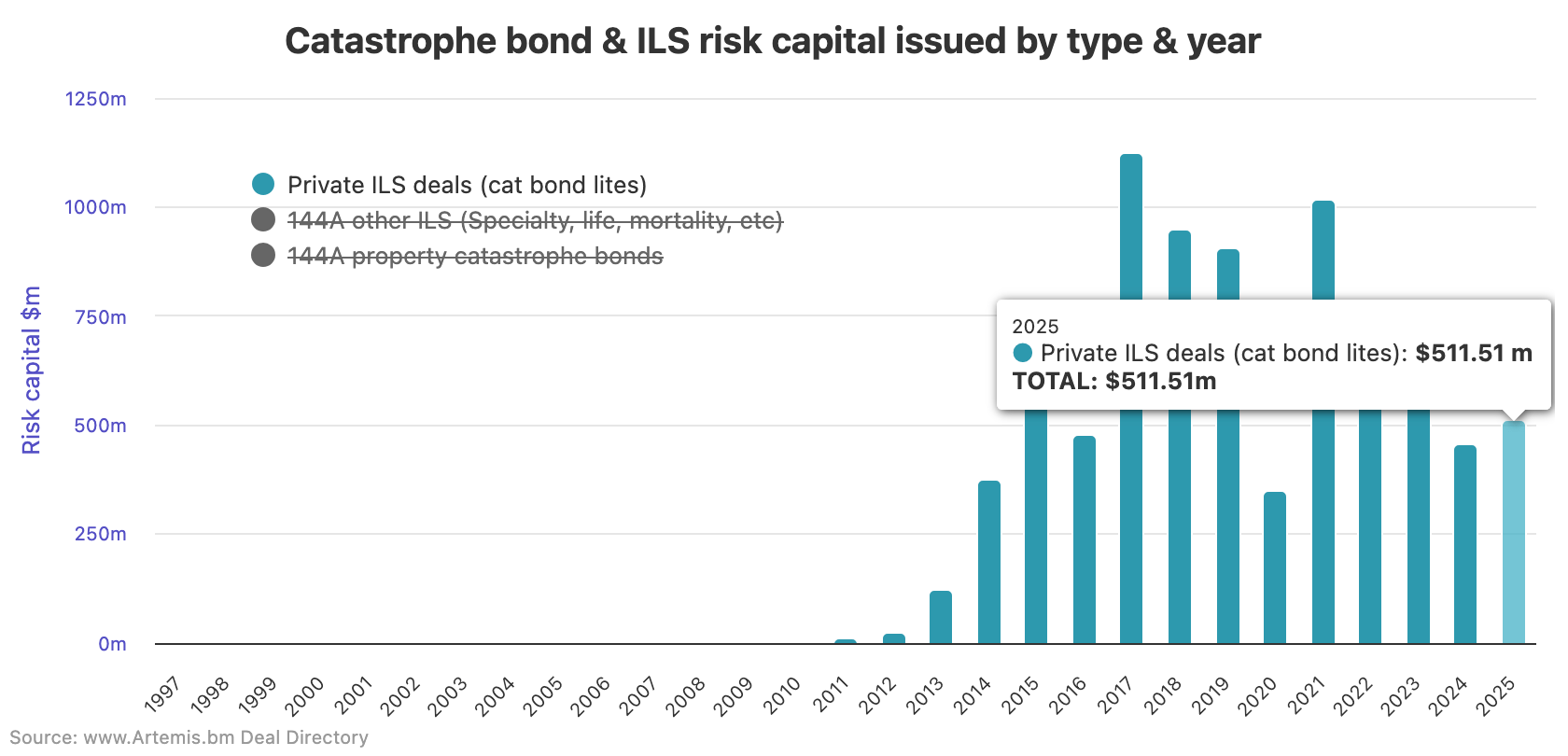

Including this issuance we have now tracked 26 of these cat bond lite transactions so far in 2025, while issuance of these privately placed catastrophe bond deals has now reached nearly $512 million.

Private cat bond issuance has accelerated in recent months, with a number of transactions from around the April and mid-year reinsurance renewal seasons helping to bolster the annual issuance total.

You can view details on every private cat bond we’ve tracked in the Artemis Catastrophe Bond Deal Directory by using the filters to view only private deals (filter by type).

The Artex Axcell Re structure has been regularly used over the years for transacting or transforming reinsurance related risks, including through the issuance of private insurance-linked securities (ILS) notes, ranging from collateralized reinsurance to private cat bonds with the assistance of facilitator Artex.

This latest transaction from the vehicle is a $15 million Kettering notes private catastrophe bond issuance.

Artex Axcell Re (Bermuda) Limited, under its ILS Note Program II, has issued $15 million in Kettering notes on behalf of a segregated account identified as PI0059, we understand.

This latest new private cat bond issuance has a maturity date of March 31st 2026, which suggests it could represent an reinsurance or retrocession transaction from around the April renewal time.

The $15 million of PI0059 Kettering notes issued by Artex Axcell Re have been privately placed with qualified institutional investors and are now listed on the Bermuda Stock Exchange (BSX).

As with all of the private ILS or cat bond deals that we report on, until we learn more details we assume this covers a property catastrophe reinsurance or retrocession risk.

With this latest private cat bond, or private insurance-linked securities (ILS) deal, annual issuance in 2025 so far of these types of arrangements tracked by Artemis is now sitting just under the $512 million mark.

It continues to seem that 2025 will be a much more active year for this type of ILS arrangement, with the total now accelerating beyond the full-year total seen for 2024.

You can analyse catastrophe bond issuance by type of deal in this chart, which you can filter using the key to view only private cat bond issuance.

You can view details on every private cat bond we’ve tracked in the Artemis Catastrophe Bond Deal Directory. Use the filters to view only private cat bonds (filter by type).

You can also track private catastrophe bond issuance by year in this interactive chart.

We’ve added this new transaction, the $15 million Artex Axcell Re – Kettering notes private cat bond, to the Artemis Deal Directory, and what data points we have on the arrangement will be included in our catastrophe bond and ILS market statistics.