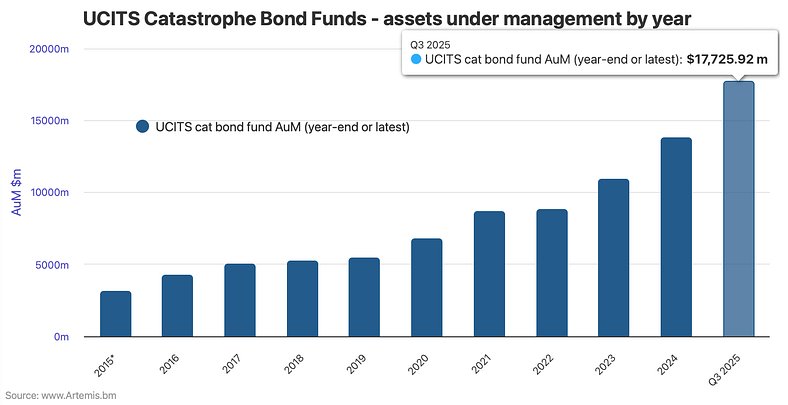

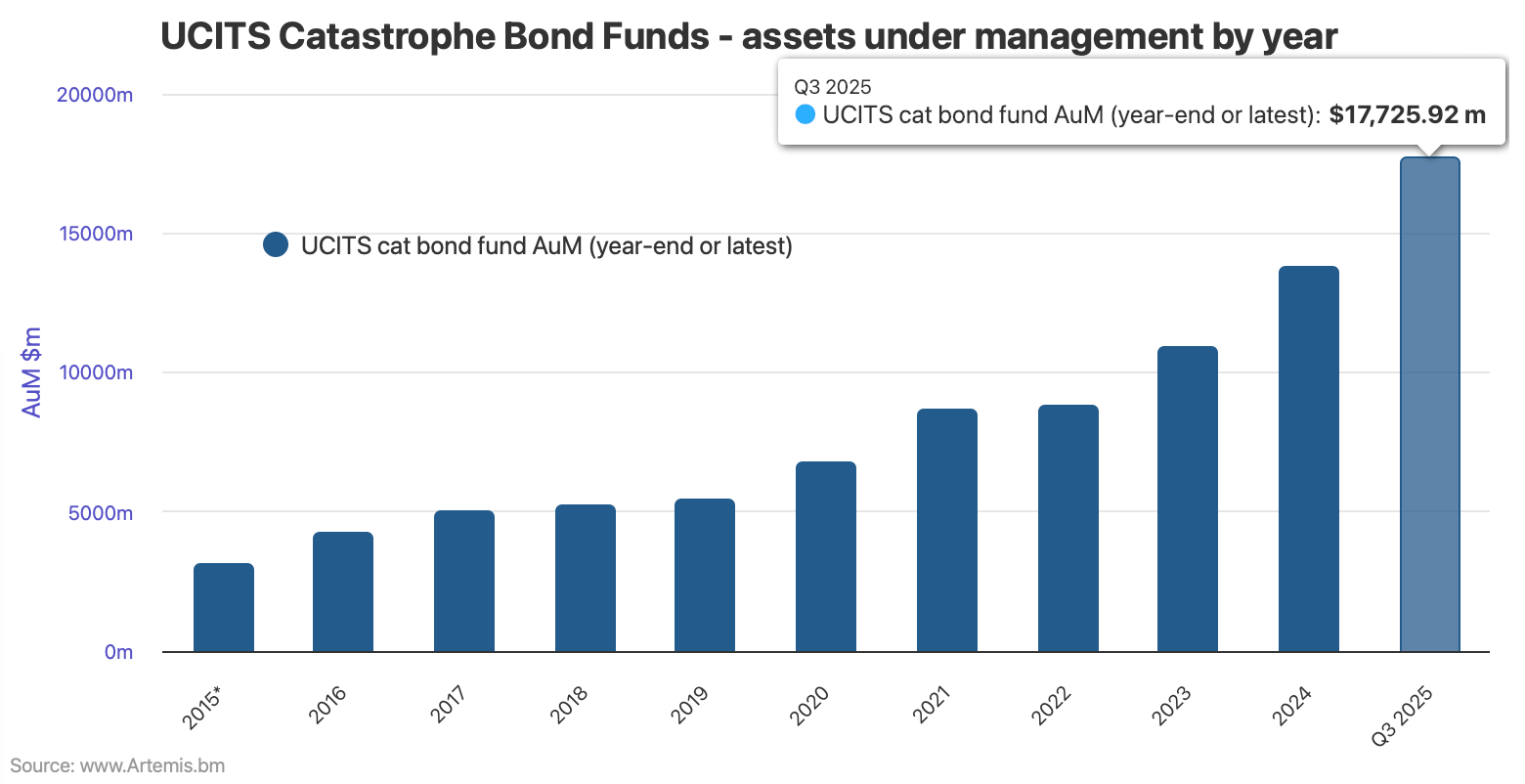

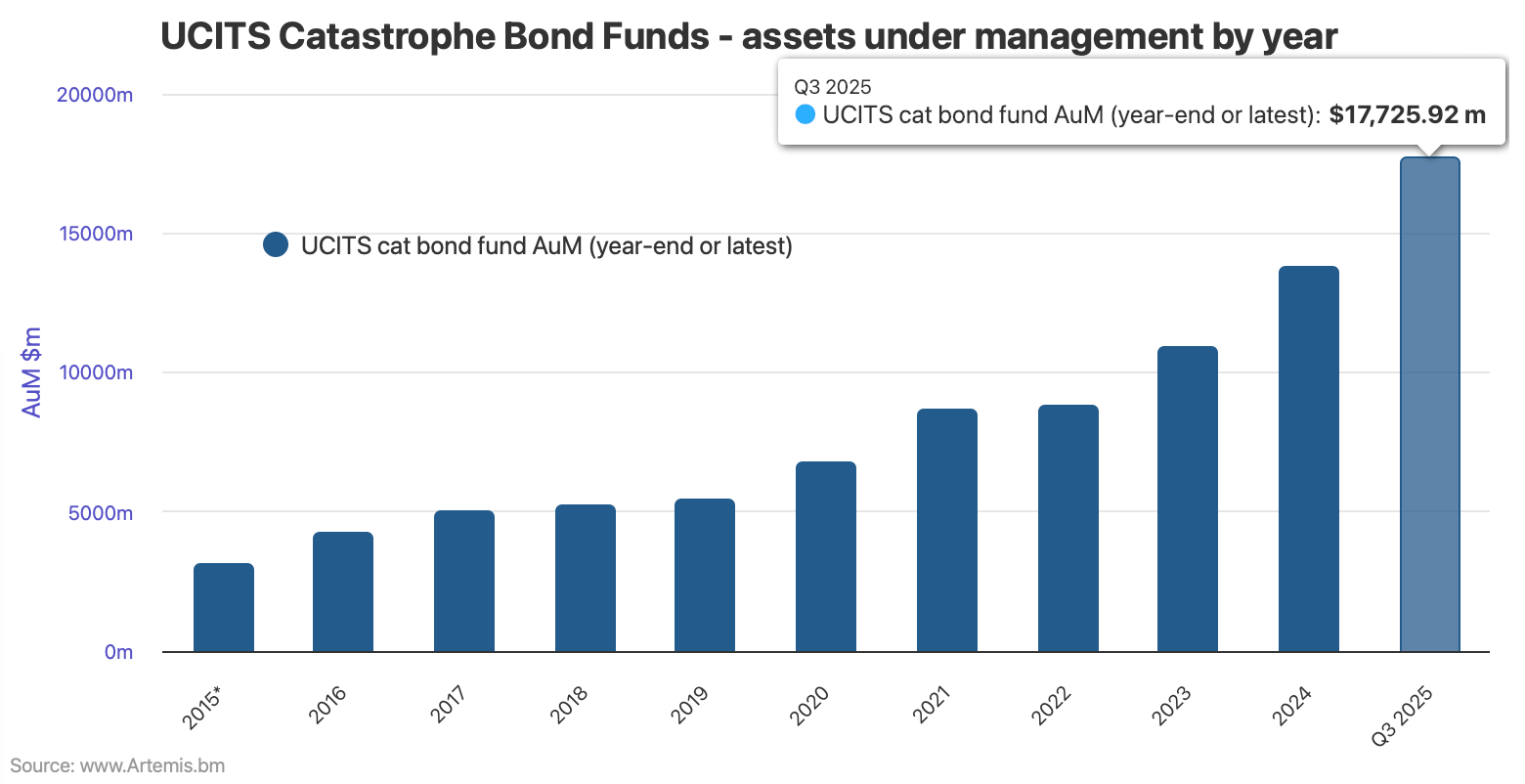

The UCITS catastrophe bond fund sector has continued to expand through the latest quarter of record, adding more than 3% in assets under management across the group of 17 UCITS cat bond funds, to reach a new high of almost $17.73 billion after September 2025. Year-to-date, to the end of Q3, the group of catastrophe bond funds structured in the UCITS format have now grown by a stunning more than 28% in 2025.

Year-to-date, to the end of Q3, the group of catastrophe bond funds structured in the UCITS format have now grown by a stunning more than 28% in 2025.

UCITS catastrophe bond funds grew strongly through 2024, hitting just over $13.8 billion in cat bond assets under management at December 31st 2024, which was growth of 26% in combined AUM over the course of that twelve-month period.

2025 so far is outpacing last year’s strong growth, as UCITS cat bond funds as a group have already added more than 28% to the end of 2024 total.

At almost than $17.73 billion in combined cat bond AUM, the UCITS fund category continues to surge on the back of accelerating and record levels of issuance of new catastrophe bonds.

The catastrophe bond market continues to break all issuance records in 2025, as detailed in our latest quarterly report and the first $20 billion plus year is now almost certain in 2025.

The pace of growth in the UCITS cat bond fund sector has been accelerating alongside this, with the supply of capital through these funds one key supporter of record cat bond issuance activity.

As you might expect, the third-quarter is typically slower for capital growth in the catastrophe bond funds sector given the onset of the Atlantic hurricane season.

In 2025, the UCITS cat bond fund segment added almost $1.4 billion in capital in the first-quarter of 2025, then over $1.86 billion in Q2 and now a further over $573 million in Q3.

That’s actually a little slower growth than seen in Q3 2024, but still one of the fastest expansions of the UCITS cat bond fund sector for the stage of the year.

Analyse UCITS catastrophe bond fund assets under management using these charts (data kindly shared by our partner Plenum Investments AG, a specialist insurance-linked securities (ILS) fund manager).

The combined cat bond assets under management across the 17 UCITS funds tracked has now risen by over $3.9 billion, or 28%, just over the course of the first nine-months of 2025.

Over the rolling-12 months back to September 30th 2024, the UCITS catastrophe bond fund sector has expanded by an impressive almost $4.68 billion, representing growth in combined assets of 36% in the last year.

This strong growth means that the UCITS cat bond funds are contributing a growing percentage of the outstanding cat bond market’s assets.

Back at the end of Q1 2025, using Artemis’ measure for the outstanding cat bond market, these UCITS funds accounted for more than 29% of cat bond risk capital, which rose to just over 30% of outstanding cat bond risk capital by the end of Q2 2025.

Now, again using our measure for the outstanding cat bond market, these UCITS cat bond funds contribute almost 32% of the market’s capital and capacity, showing that they have continued to outpace the overall growth trajectory of the cat bond market.

There has been growth across the majority of the UCITS cat bond fund sector this year, although it remains uneven.

The Twelve Cat Bond Fund, managed by insurance-linked securities (ILS) investment manager Twelve Securis, remains the largest at almost $4.32 billion as of September 30th, having grown nearly 29% in 2025 alone.

Next, the Schroder Capital managed GAIA Cat Bond Fund has grown 13% to reach almost $3.94 billion by the end of September.

Next largest now is the Fermat Capital Management managed Fermat UCITS Cat Bond Fund, which is also the fastest grower in 2025, having added more than 210% in AUM to reach over $2.33 billion by the end of Q3.

In fourth place, in size terms as of the end of Q3, is the Leadenhall Capital Management operated Leadenhall UCITS ILS Fund, which has grown by almost 49% to reach nearly $1.63 billion.

Fifth place, in size terms, is the GAM Star Cat Bond Fund, now portfolio managed by Swiss Re and GAM, which has shrunk 38% after the changes instigated this year, to end September with just over $1.59 billion in assets under management.

The three largest UCITS cat bond funds now make up 60% of the sector’s assets, while the top five which are the only strategies to surpass a billion dollars in size, make up 78% of assets for the group.

Other UCITS cat bond funds experiencing particularly strong growth in 2025 include the Plenum CAT Bond Dynamic Fund which is up 98% this year to reach $441 million in assets, the Icosa Cat Bond Fund which is up 88% at $601 million in assets, the AXA IM Wave Cat Bonds Fund which is up 58% at $396 million in AUM, the Franklin K2 Cat Bond Fund which is up 52% at $218 million, and the Plenum CAT Bond Defensive Fund which is up 42% to reach $579 million.

It remains largely a story of growth and asset expansion in the catastrophe bond fund sector in 2025.

With the cat bond market issuance pipeline now expected to come to life over the next few weeks, there will be more chances to raise assets and grow these funds and the UCITS sector further.

While the recent ESMA viewpoint raised some uncertainty around use of the UCITS fund structure in delivering pure cat bond investment strategies, our sources suggest the timeline to any required changes will be meaningful and the general feeling remains that alternative fund structures will suit the vast majority of investors allocated to cat bonds in the UCITS space.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.