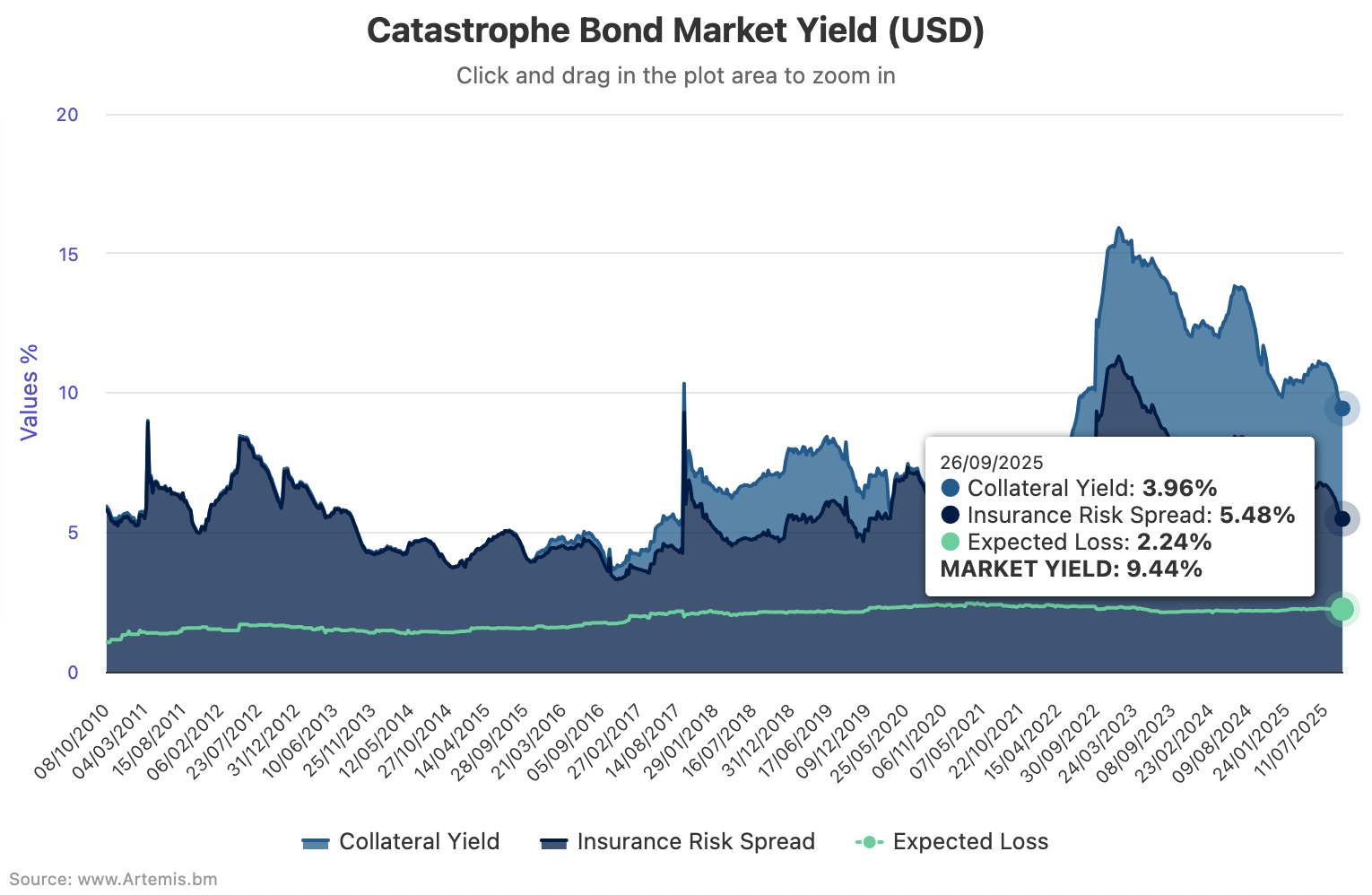

The overall yield of the catastrophe bond market declined further in September 2025 as seasonal spread tightening continued to be the major factor affecting that metric, with insurance risk spreads, or the cat bond market discount margin, now back at levels seen around the same stage of the year in 2021.

Last month saw a continuation of the hurricane-related seasonal effects that began pressuring yields back in early July, which is to be expected given the peak of the hurricane season is often said to be around the September point of the year.

As a result, September is often the month where seasonality has its largest effect on insurance risk spreads and the yield of the catastrophe bond market, with 2025 following to form so far.

But, also evident in the September data update on catastrophe bond market yields from specialist manager Plenum Investments, is the fact the market has softened considerably over the last year, in-line with (or perhaps running somewhat ahead of), traditional catastrophe reinsurance rates-on-line at this time.

The overall yield of the catastrophe bond market had sat at 11.03% at the end of June 2025, then declined to 10.81% by August 1st and 10.22% as of August 29th.

It has now declined further to approximately 9.43% as of September 26th, the last end-of-week data point of that month, as the hurricane season spread tightening continued (note, it shows as 9.44% in our chart due to automatic rounding).

You can analyse the yield of the catastrophe bond market over time in our interactive chart, which uses data kindly shared by Plenum Investments.

Spread tightening driven by hurricane seasonality results in higher return performance for the cat bond market, something witnessed in the September data of many catastrophe bonds funds. The cat bond fund reports we’ve seen so far suggest another very strong month, following on from high performance levels in July and August.

The yield of the catastrophe bond market at September 26th 2025, sat at its lowest level since July 2022.

The insurance risk spread, or discount margin, fell to 5.48% at September 26th 2025, falling from 6.07% when we last reported this data at August 29th.

That’s the lowest level the cat bond market risk spread has reached since early January of 2022 and for an end of September figure it is now close to the level seen in late September 2021.

The collateral yield, or risk free return, remains far higher than it was at that stage, but it too has begun to compress, now having declined from 4.3% at the end of June to 3.96% by late September this year.

The cat bond market yield above expected loss sits at 7.20% as of late September, which remains attractive historically and continues to offer a healthy diversifying investment opportunity to investors.

Plenum Investments commented on the outlook for the coming weeks that, “Market yields continue to follow their usual seasonal spread-tightening pattern. For the remaining part of the hurricane season, we expect the spread tightening to ease slightly, as about 20% of the season still lies ahead.”

Analyse catastrophe bond market yields over time using this chart.